As a rule, Kirigueti doesn’t get a whole lot of visitors. This pueblito of 207 families lies a full day’s journey from Ivochote, the last town accessible by dirt road in Peru’s southeastern Amazon. Reaching Kirigueti entails hitching a motorboat down the Urubamba River, crossing the Pongo de Mainique rapids, and continuing east as the Andean foothills flatten into blazing, humid planes of remote jungle.

Nonetheless, over the past few years, this community of indigenous Machiguenga has experienced dramatic change. The pankothi  huts,

broad-leafed trees, and ubiquitous yuca-based masato drink remain as

they have for centuries. But some of the new homes are two-story wooden

houses with tin roofs. Gaslights illuminate the village at night, and

televisions blare jingles over the noises of children, chickens, dogs,

and toucans.

huts,

broad-leafed trees, and ubiquitous yuca-based masato drink remain as

they have for centuries. But some of the new homes are two-story wooden

houses with tin roofs. Gaslights illuminate the village at night, and

televisions blare jingles over the noises of children, chickens, dogs,

and toucans.

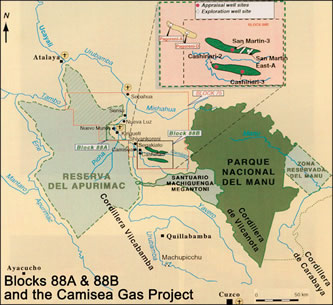

Along with Machiguenga, the Urubamba is home to Nanti, Nahua, and Yine indigenous communities. It is an environmentally as well as socially sensitive area: as one of the most biodiverse regions in the world, the Urubamba is of global ecological significance. It also holds generous reserves of natural gas, currently being exploited by the Camisea Consortia. Pluspetrol, lead operator of extractions in the Bajo Urubamba, paid the community of Kirigueti $266,000 for the right to conduct two years of drilling on Machiguenga territorial land. Despite the televisions and gas energy, Kirigueti residents remain critical of the Consortia. “Because of the noise from helicopters and big boats, there are no fish left in the Urubamba River, and the animals have fled to the mountains,” says Marcelino Turco, vice president of Kirigueti. “And last year, half of our community was sick.”

One hundred fifty new cases of syphilis were recently reported in Kirigueti. The introduction of foreign workers has historically brought new and often lethal diseases to indigenous populations. There is a clinic in Kirigueti; it was built by optimistic Catholic missionaries, and holds a laboratory, examination room, dentistry, surgery, pediatrician’s room, gynecologist’s room, and pharmacy. But the building is dilapidated, the equipment outdated, and the clinic entirely lacking in medical staff. “We need a doctor, nurses, a dentist, an obstetrician,” says Eugenia Davila, who works in the empty clinic administering pharmaceuticals. “Pluspetrol does help, but we have to give them a list of our costs first. And we have had to fight for compensation. They didn’t want to give us anything. They didn’t invite us to negotiations with the government in Lima, because they didn’t want to consult with us. They come here to develop, to improve, and leave us worse off.” The companies of the Consortia have granted financial compensations, although in some communities they have illegally attempted to extend their initial offers to cover the entire 40-year projected duration of the project. They have also insisted on fiscally managing the compensation, but have not initiated real development projects in affected communities – projects that would significantly help, like staffing the clinic in Kirigueti. And this is merely the tip of the iceberg.

Deemed by California-based NGO Amazon Watch “the most damaging project in the Amazon Basin,” the Camisea Gas Project has been the subject of widespread controversy in Peru. Up to 75 percent of gas extractions will be operated within a state reserve set aside for indigenous peoples living in voluntary isolation. Along with extractions, the $1.6 billion endeavor includes a second consortium managing transport. The Transportadora de Gas del Peru (TGP) is charged with the construction of two pipelines leading through these sensitive regions to the Peruvian coast. In addition, the Camisea project includes a processing plant currently being built within the buffer zone of a marine reserve.

The final phase of the project

will be the construction of a plant to liquefy gas for export to the

US. This phase is estimated to cost an extra $1–2 billion, and is being

led by Texas-based Hunt Oil, which shares majority shareholder status

in the Camisea Consortia with Pluspetrol. Hunt Oil holds intimate ties

with the Bush administration: CEO Ray L. Hunt was a contributor to

Bush’s presidential campaign, and also sits on the Board of

Halliburton. Kellogg Brown & Root, a unit of Halliburton, will

build the plant. Half of the Urubamba’s gas will be shipped to the West

Coast; according to Amazon Watch, such an influx of cheap gas risks

effectively undermining California’s clean energy programs.

The Camisea project proposal displayed such flaws that financing requests were rejected by the Overseas Private Investment Corporation, Citigroup, and the United States Export-Import Bank. Yet the Inter-American Development Bank (IDB), notorious for its failure to impose environmental requirements, approved a direct loan of $75 million and a syndicated loan of $60 million in September of 2003. The IDB held its annual meeting in Lima’s Museo de la Nación on March 29–31. The area surrounding the Museo was cordoned off for a full three blocks, and patrolled by 2,500 armed militia. Protestors gathered in the permitted area, well beyond either sight or hearing of meeting participants, to air their grievances.

“The IDB’s environmental policy is 25 years old, and 500 words long,” says Amazon Watch Executive Director Atossa Soltani. “It’s at the bottom of the barrel. The Camisea Project opens up one of the most intact tropical forests and culturally sensitive areas left on the planet. It brings disastrous consequences for the indigenous people living along the river and the uncontacted peoples inside the state reserve.” In April of 2002, Pluspetrol violated internationally recognized indigenous people’s rights by forcibly contacting members of the Nahua community living in voluntary isolation within this reserve. In the 1980s, up to half of the Nahua population was wiped out by diseases introduced by workers from Shell, which was drilling in the area.

The Machiguenga community of Shimaa lies upstream of the Pongo de Mainique in the Alto Urubamba. Their pankothi face out onto a gorgeous vista of a river and jungle-covered hills. Yet the hill overlooking the village bears the scars of recent development: a path 20 to 25 meters wide has been razed through the forest, cleared for the two pipelines that snake down the hill, and across the river, and continue westward until they vanish into the horizon. “They promised us $170,000 in compensation,” says Shimaa President Damian Torres Esteban. “But they have only given us 178,000 soles [approximately $51,000].” The TGP constructed the pipes following the ridgetop – opting for the shortest, cheapest, and least environmentally sensitive route. Despite the TGP’s planting grasses in an effort to control erosion, there have been heavy landslides in Shimaa, which have severely impacted the community’s access to both drinking water and fish.

Unfortunately, the Camisea project is not the exception when it comes to the IDB. The Bank holds a veritable rogue’s gallery of controversial projects targeted by local activists for their heavy environmental, sociocultural, and health-related impacts. However, unlike the World Bank, which has been forced to heed its own environmental policies, the IDB has yet to gain the attention of US and European NGOs. Thus the IDB can get away with financing these slipshod projects. The IDB often makes loans that are directly in line with structural adjustments the International Monetary Fund (IMF) has imposed – such as opening up energy resources to maintain payments on external debt. “The IDB is a tool of the IMF,” says Juan Houghton, an organizer with ONIC, the National Indigenous Organization of Colómbia. “Public pressure has modified the policies of the World Bank, so now the IDB does its dirty work. It makes loans in order to facilitate privatization and corporate investments.” The IMF proposes structural adjustments as a means to economic survival for struggling countries, and when it comes to Latin America, the IDB steps in and offers the loans. The US, with a 30 percent stake, is the largest shareholder in the IDB.

Many of the projects financed by the IDB involve the selling and transportation of energy resources. According to a study published in March by the Sustainable Energy and Economy Network (SEEN), the IDB has financed 49 fossil fuel pipeline, power, and related projects with $6.27 billion between 1992 and 2004. Together, these projects will generate emissions in quantities more than double those of all of Latin America in 2000. Also, according to SEEN, of the top 15 corporate beneficiaries of IDB energy projects, half are based in the US, and Enron ranks fourth among beneficiaries. (Only one of the top 15 is based in Latin America – Petrobras, of Brazil.) Meanwhile, Peru is saddled with a $22.8 billion debt. The IDB is the principal creditor, with loans covering close to 25 percent. Given the government’s position, it hardly makes sense to argue with the IDB.

The Termoelectrica Del Golfo is another controversial IDB-financed energy project, based in Mexico. It is a petroleum-coke-fired power plant used to generate electricity for 13 cement factories in Mexico; critics cite inadequate review of public health and environmental impacts, as well as violations of Mexican law. The Transredes pipeline expansion in Bolivia, partially owned by Enron, crosses both indigenous territorial land as well as four ecologically sensitive areas; the IDB approved the loan despite Enron’s filing for bankruptcy a year prior. The Bolivia to Brazil gas pipeline is yet another example of the IDB’s priorities: the vast majority of the gas is to be consumed by industrial markets, despite the fact that an estimated 20 million people living in rural Brazil lack access to power.

Why

is the IDB investing so heavily in energy? Because of the massive US

market. Many of these projects are sending their reserves straight up

north via a vast transportation network also funded by the IDB. The TGP

is a part of this network, as is Plan Puebla Panama, which aims to

network all of Central America to the US, and in which the IDB has

invested an estimated $4 billion. The IDB is funding a similar project

currently in the works in South America: the Regional Infrastructure Integration in South America project (IIRSA), a transportation, telecommunications, and

energy-focused initiative that aims to connect 12 South American

countries. In line with the IMF, the IDB promotes an agenda of

integration that speaks to the needs of multinational corporations,

facilitating the movement of energy and other resources northwards. And

the IDB gets away with this because it is not the World Bank, and we

aren’t paying enough attention.

Why

is the IDB investing so heavily in energy? Because of the massive US

market. Many of these projects are sending their reserves straight up

north via a vast transportation network also funded by the IDB. The TGP

is a part of this network, as is Plan Puebla Panama, which aims to

network all of Central America to the US, and in which the IDB has

invested an estimated $4 billion. The IDB is funding a similar project

currently in the works in South America: the Regional Infrastructure Integration in South America project (IIRSA), a transportation, telecommunications, and

energy-focused initiative that aims to connect 12 South American

countries. In line with the IMF, the IDB promotes an agenda of

integration that speaks to the needs of multinational corporations,

facilitating the movement of energy and other resources northwards. And

the IDB gets away with this because it is not the World Bank, and we

aren’t paying enough attention.

Back in Kirigueti, the new gas power goes out at 9 p.m. With startling suddenness, televisions cease jangling, lights fizzle out, and the pueblito is dark.

Marisa Handler is a writer, activist and musician living in San Francisco. She has worked as an organizer for the peace and anti-globalization movements within the US.

What you can do: Hunt Oil Company is the majority investor in Camisea. Call or send a

letter to CEO Ray L. Hunt, demanding that Hunt withdraw all operations

from the Nahua-Kugapakori Reserve. Ray L. Hunt, CEO, Hunt Oil Company,

Fountain Pl., 1445 Ross at Field, Suite 1400, Dallas, TX, 75202-2785

(214) 978-8000, fax: (214) 978-8888

We don’t have a paywall because, as a nonprofit publication, our mission is to inform, educate and inspire action to protect our living world. Which is why we rely on readers like you for support. If you believe in the work we do, please consider making a tax-deductible year-end donation to our Green Journalism Fund.

DonateGet four issues of the magazine at the discounted rate of $20.